Annual report and accounts 2023 to 2024

This is our annual report and accounts for the period of 1 April 2023 to 31 March 2024. We set out our objectives, describe what we have achieved during the year, and explain our governance and financial resources.

Annual report and accounts 2023 to 2024

Published: 30 July 2024

About

This is our annual report and accounts for the period 1 April 2023 to 31 March 2024.

This document was presented to Parliament pursuant to paragraph 19, schedule 3 of the Children and Social Work Act 2017. It was ordered by the House of Commons to be printed on 30 July 2024.

Reading this document

For the best reading experience, we recommend viewing the PDF version of this document.

You can also access a large print PDF version.

The document is also available in plain text below.

Plain text version of our annual report and accounts 2023 to 2024

Contents

- Overview from the chair and chief executive

- Performance overview

- Performance analysis

- Financial commentary

- Corporate governance report

- Director's report

- Statement of Accounting Officer’s responsibilities

- Governance statement

- Remuneration and staff report

- Parliamentary accountability report

- The Certificate and Report of the Comptroller and Auditor General to the Houses of Parliament

- Financial statements

- Statement of comprehensive net expenditure

- Statement of financial position

- Statement of cash flows

- Statement of changes in taxpayers’ equity

- Notes to the financial statements

Overview from the chair and chief executive

Welcome to our annual report and accounts for 1 April 2023 to 31 March 2024. Here we reflect on the work we’ve undertaken over the first 12 months of our current 3-year strategic period, including the challenges we’ve faced, what we’ve learned and how we can continue to improve.

Every day, social workers support millions of people to improve their chances in life. They listen to, support and empower people, protecting people from harm when necessary. And they must ensure those that they work with are always treated with dignity and care, and that their wishes, feelings and needs are considered.

In undertaking this important and complex role, social workers must act with integrity and maintain high ethical and professional standards. Regulation means that the public can expect the social workers they engage with to meet clear professional standards, providing assurance and protection.

Our success requires us to build trust and confidence with the profession and create a clear understanding of the need for, and responsibilities of, a professional regulator. Building on our research findings into public perceptions of social work, we launched a campaign during Social Work Week to raise awareness of the positive impact social workers have on people’s lives. It was wonderful to see the campaign receive such a positive reaction, both within the profession and among the public.

Reducing risk and preventing harm needs to be delivered in partnership across the sector. This report indicates that we’ve made good progress in developing our work with employers, social workers, educators and the public. We’re pleased to report that we’re making good progress in improving our overall efficiency and effectiveness across the organisation. This was reflected in our latest performance report from the Professional Standards Authority, where we’re pleased to have met 17 of the 18 standards of good regulation.

With our unique view of the whole profession, people continue to look to us to share learning, data and insight about social work. Alongside the publication of several pieces of research during the year, we also shared further data and insight that we hold about the social work profession and our regulation. Not only has this increased our openness and transparency, but it enables us to support leaders and policy makers to plan for change.

We’ve also been able to contribute to the development of national policy and statutory guidance. This included collaboration with the Department for Education on plans to reform children’s social care as set out in their ‘Stable homes built on love’ strategy. We’ve also engaged with the Department of Health and Social Care’s strategy ‘People at the Heart of Care’ for adult social care.

Every concern raised to us about a social worker is taken seriously and considered by our fitness to practise process. We’ve seen improvements in the outcomes for people at the various stages of our fitness to practise process. However, we know that overall it is taking us too long to resolve cases, something that was confirmed by the Professional Standards Authority review. We acknowledge that it’s not acceptable to have such delays. We understand the distress this can cause to social workers and to people who have made a complaint. It remains a cause for concern for all of us and we continue to work on ways we can to address this.

Finally, we thank and recognise our staff, our board and all others who work for and with us, for their continuing hard work and commitment to public protection. Together, in line with the objectives we set in our latest business plan, we’ll continue to address challenges, recognise success and strive for continued improvements to the way we regulate.

We’ll be guided by our values and culture, by our legislation and statutory responsibilities, and by our ongoing commitment to equality, diversity and inclusion.

Dr Andrew McCulloch

Interim Chair of the Board, Social Work England

Colum Conway

Chief Executive and Accounting Officer, Social Work England

Performance overview

The performance report explains who we are, our purpose, how we are organised and our performance against objectives. Overall, our performance for 2023 to 2024 was in line with what we set out to achieve in our business plan for the year.

Our purpose and activities

We are a specialist regulator focused on enabling positive change in social work.

We believe in the power of collaboration and share a common goal with those we regulate - to protect the public, enable positive change and ultimately improve people’s lives.

Social Work England was established under the Children and Social Work Act 2017 (‘the Act’). We are the single-profession regulator for social workers in England. Our powers and obligations are set out in part 2 of the Act and the Social Workers Regulations 2018 (‘the Regulations’). The Regulations were amended in December 2022. The changes covered a wide range of areas, including changes to our data sharing powers.

We operate as a non-departmental public body and are classified as a central government organisation. We agreed our framework document with our sponsor the Department for Education, in consultation with the Department of Health and Social Care. The Department for Education has responsibility for child and family social workers. The Department of Health and Social Care has responsibility for adult social workers.

As stated in the Act, and like the other health and care regulators, our overarching objective is the protection of the public.

In pursuing our overarching objective we aim to do all of the following:

- protect, promote and maintain the health, safety and wellbeing of the public

- promote and maintain public confidence in social workers in England

- promote and maintain professional standards for social workers in England

The Regulations detail the framework within which we regulate social workers. We’re responsible for delivering key regulatory functions by:

- setting profession-specific education and training standards and approving training courses

- setting profession-specific standards for fitness to practise

- maintaining a register of all social workers in England

- running a fitness to practise system

- monitoring and reporting on continuing professional development

- approving post qualifying courses and specialisms

Professional Standards Authority

Our regulatory activities are overseen by the Professional Standards Authority (the Authority). They review and scrutinise our performance against their standards of good regulation.

In March 2024, the Authority published its review of Social Work England for the period 1 January to 31 December 2023. We were pleased to have met 17 of the 18 standards, improving on the 16 we met in the previous period (1 December 2021 to 31 December 2022).

The review identified how we share valuable learning, insight and research. It also recognised that we continued to face challenges with timeliness in some parts of our fitness to practise process. It was for this reason that we did not achieve one of the standards. The review highlighted that we have taken several actions to improve in this area.

Our values

Our values shape and steer how we work. We’re proud of our values and what they mean to us.

- Fearless: Influence and drive change where needed

- Independent: Carry out our work without undue influence from anyone

- Ambitious: Have high aspirations for the social work profession, for regulation and for ourselves

- Integrity: Work with integrity in every aspect of our business

- Collaborative: Work with experts in the social work profession

- Transparent: Be honest and open about what we’re doing and how we’re doing it. Seek and act on feedback

Our leadership team

- Chief Executive and Accounting Officer: Colum Conway

- Executive Director, People and Business Support: Linda Dale

- Executive Director, Regulation: Philip Hallam

- Executive Director, Professional Practice and External Engagement: Sarah Blackmore

How we measure and report performance

Our executive leadership team tracks performance and milestones on a monthly and quarterly basis, including measuring against key performance indicators.

Our board reviews our performance on a quarterly basis. Our regular audit and risk assurance committee meetings support them in their responsibilities. They provide assurance in the areas of audit, risk management, governance and internal control.

Our quality assurance team conducts process reviews and internal audits. They ensure that we operate effectively and align with our statutory purpose to protect the public.

We have a formal quarterly strategic and performance review meeting with the Department for Education and the Department of Health and Social Care. We have regular ongoing contact with the sponsor team at the Department for Education. Our accounts are consolidated within the Department for Education’s annual report and accounts.

We engage with the Professional Standards Authority. They review and scrutinise our performance against their standards of good regulation. They also review our independent adjudicators’ decisions on fitness to practise concerns.

Performance summary

Our strategy sets out our 3 year ambitions for the period 1 April 2023 to 31 March 2026. We developed it in partnership with staff and our National Advisory Forum, including people with lived and learned experience of social work. Our board endorses the strategy. It builds on the achievements, challenges and learning from our first 3 years.

The strategy focuses on the following 3 strategic themes where we aim to have an impact on the next stage of our journey.

• Prevention and impact

• Regulation and protection

• Delivery and improvement

For each strategic theme, we set one year business plan objectives. Our performance monitoring and reporting reviews our progress against these objectives.

Overall our performance for 2023 to 2024 was in line with what we set out to achieve in our business plan for the year.

Prevention and impact

Business plan objective 1.1: develop an inclusive communications and engagement approach to improve understanding about social work and the value of our professional standards.

We have met this objective by engaging with many audiences through a variety of activities. This included:

• expanding the membership of our National Advisory Forum, recruiting more people with lived and learned experience of social work

• running our fourth Social Work Week held in March 2024, with over 6,500 people attending the 21 main sessions. The sector also embraced the week, delivering over 40 independent sessions

• delivering campaign activity to start a national conversation on the consequences that negative depictions of social workers in TV and film have on society. We delivered this activity under our #ChangeTheScript campaign

• engaging with a total of 10,891 external stakeholders across the social work sector.

We've established a baseline for raising confidence in our role, the professional standards and how valued social workers feel their work is. We'll continue to seek out opportunities to inform, educate and influence others on the varied role social work plays within society.

Business plan objective 2.1: implement our data and insight strategy

This year we began to develop and share more of the data and insight we hold about the social work profession and our regulation. This included:

• publishing regular data about our social work register, fitness to practise referrals and case outcomes and overseas applications

• publishing an initial analysis of social workers’ diversity data in relation to our fitness to practise process. Doing so was a significant first step towards a comprehensive understanding of fairness in our processes, informing the future analysis and actions we need to take in response

• commissioning research about the social work profession and people’s experiences and perceptions of the sector. The findings were consistent with previous intelligence that we’ve gathered. We are using this learning to inform the way we engage with the profession and the public.

We've met this objective which has increased our openness and transparency, enabling us to support leaders and policy makers to drive change. This transparency will also help to ensure that our processes are safe and fair. We'll continue to explore and share our data, insight and research findings, supporting wider learning across the sector.

Business plan objective 3.1: influence and advise on development of national policy and statutory guidance

We've advised on significant review and reform this year, particularly in children’s social care. This has included:

• advising on the development of national policy in children’s social care as a result of the Department for Education’s Stable

Homes, Built on Love strategy. We also provided a response to the Department of Health and Social Care’s proposals to reform the workforce pathway for adult social care

• sharing our research findings at national roundtables, to support planning that addresses workforce challenges

• collaborating with the Department for Education on plans for an early career framework for children and families social workers.

Responding to and advising on proposed changes in the sector saw us meet this objective this year. We will continue to influence and advise on national policy.

Business plan objective 4.1: develop and implement the readiness for professional practice guidance

During the year, we established the Social Work Education and Training Advisory Forum for education stakeholders. Ongoing conversations with the sector and people with lived experience of social work have supported our development and drafting of readiness for professional practice guidance.

We've partially met this objective, as we are due to finalise and implement the guidance in 2024. This guidance will help to ensure that those entering the profession are prepared to meet the professional standards required of them for safe and effective practice.

Business plan objective 4.2: review our approach to course inspections, reapprovals and quality assurance

We continued to work with course providers to ensure that all social work students receive comprehensive, consistent education and training to prepare them for practice. This included:

• completing 74% of course reapproval decisions, achieving our target of 70% by 31 March 2024. We are on track to complete our current cycle of course reapproval inspections by December 2024

• completing annual monitoring with all 78 education and training providers in England

• surveying course providers to gauge their experience of our inspection process to help inform their future direction

• continuing to streamline our approach to systems and inspection processes.

While our progress against this objective is significant, we've postponed the review of our approach to course inspections until we complete the full cycle. Doing so will allow us to learn from our engagement with all course providers.

We've gained a huge amount of experience and intelligence since we began regulating. The recent Professional Standards Authority audit confirmed that our approach continues to require providers to take action to ensure they meet our standards. The Authority received positive feedback from stakeholders about our approach to inspections.

As part of our inspections we survey documentary evidence at depth with the course provider and their stakeholders. This approach has meant that all courses that we have reapproved or approved meet the current education and training standards.

Regulation and protection

Business plan objective 5.1: identify opportunities to improve the timeliness, fairness and quality of our registration and advice processes

Business plan objective 5.2: identify ways we can improve the timeliness of overseas applications

Business plan objective 5.3: review our approach to concerns about misuse of title of social worker

We have met these objectives by taking steps to ensure that our registration processes remain fair, responsive and efficient. This included:

• procuring new software to support handling of enquiries. With this support we increased our responsiveness and we continued to meet our targets for time taken to answer phone calls and emails

• continuing to meet our key performance indicators for the timeliness of both UK registration applications and applications to restore to the register

• publishing refreshed public guidance to support applicants with the registration process

• undertaking a number of activities to improve fairness, including reviewing our process for assessment of UK, overseas and restoration applications

• publishing guidance on misuse of title cases.

During 2024 to 2025, we’ll look to implement the improvements we’ve identified and further develop our approach.

Business plan objective 6.1: identify opportunities to bring more investigative activity into earlier stages of the fitness to practise process

Business plan objective 6.2: optimise our approach to accepted disposals

Business plan objective 6.3: ensure our hearings process is efficient and delivers value for money

Business plan objective 6.4: demonstrate impact following changes to revised legislative framework

We met these objectives through quality assurance activities aimed at helping us to understand where we needed to develop or improve our work. We reviewed our approach to fitness to practise case resolution to improve service quality. This included:

• delivering a programme of learning and development activity. This programme supports ongoing work to bring more investigative activity into the early stages of the fitness to practise process

• dedicating significant focus to conclude almost all of the legacy caseload inherited from the Health and Care Professions Council

• reviewing how we use financial resources across the fitness to practise process. Doing so helped us to gain a better understanding of our challenges, and where efficiencies have and could be made.

• continuing to focus on timeliness of the triage and investigation stages

• reviewing the learning from the changes to our legal framework.

Our analysis shows that the 5 key changes to the legal framework in 2022 have brought financial efficiencies while not compromising the quality of casework and decision making.

Business plan objective 7.1: develop our single point of contact network and explore local resolution pathways

We've partially met this objective, taking steps to develop our work with employers and the public to resolve more concerns locally. These steps included ensuring that our approach is proportionate, looking to resolve concerns as efficiently and effectively as possible, at the earliest appropriate stage.

We maintained a single point of contact within major employers, with the aim of supporting organisations to manage and respond to our requests for information. We also collaborated with employers and others to understand how local concern and complaint processes are working.

Due to capacity constraints, we've now planned further exploration work for 2024 to 2025. We'll evaluate the network and consider our approach to developing it further.

Delivery and improvement

Business plan objective 8.1: conduct user research to identify how to improve digital user experience

We met this objective by developing and implementing a new approach to how we involve users of our services in our work. This work allowed us to identify and bring together diverse participants to feedback on and shape our digital content. In February 2024, we delivered user research on how we can improve our raise a concern service.

We completed an accessibility audit on our website to ensure that we remain inclusive. We also updated and published our accessibility statement on our website, being transparent with users on where we still need to make improvements.

Business plan objective 9.1: implement our people strategy

We met this objective by launching our 3 year people strategy and continuing our work towards becoming a diverse and inclusive employer. This included:

• publishing our revised people policies, with the support of feedback groups

• putting in place targeted opportunities for leadership development

• improving our recruitment approach

• continuing to improve our overall rewards package

• receiving the results of our latest Talent Inclusion and Diversity Evaluation (TIDE) which show our overall score improved to 70%, an increase of 4% on last year

• publishing our equality, diversity and inclusion action plan for 2023 to 2024.

During the year we became a Disability Confident employer. We signed up to the Race at Work Charter and Mindful Business Charter. And we developed our positive action mentoring scheme.

Business plan objective 10.1: further develop and communicate our quality and assurance frameworks

Business plan objective 10.2: evaluate our economy, efficiency and effectiveness, and demonstrate value for money improvements across the organisation

Business plan objective implement our corporate sustainability plan

To meet these objectives we've continued to improve the way we work. We developed an assurance framework, which we have initially implemented across all of our regulatory departments. This process identified adequate controls already in place as well as areas for future improvement.

We evaluated how well we’re using public funds. As a result, we know where we can be confident that we’re providing value for money and where we need to gather more evidence.

We also implemented our sustainability plan. We’ve made good progress in reducing waste and increasing recycling.

Key performance indicators

In addition to our strategic and business plan objectives, we set key performance indicators to monitor our performance and progress during the year.

We achieved most of our key performance indicator targets in 2023 to 2024. High caseloads and resourcing challenges impacted on timeliness at the triage and investigations stage of fitness to practise. We have reviewed our processes and are investing in additional staff to improve timeliness in 2024 to 2025.

Our sickness absence has also been higher than average for the public sector. We supported people to return to work and by the end of March 2024, had no ongoing long-term absence cases.

Education and training key performance indicator

Key performance indicator: completed course reapproval decisions (cumulative)

Target: 70% by March 2024

Timeframe: at 31 March

2023 to 2024: 74% (target achieved)

2022 to 2023: 32% (target missed)

Registration key performance indicators

Key performance indicator: time taken to approve UK registration applications

Target: less than or equal to 10 working days median

2023 to 2024: 3 working days median (target achieved)

2022 to 2023: 5 working days median (target achieved)

Key performance indicator: time taken to approve restoration applications

Target: less than or equal to 20 working days median

2023 to 2024: 3 working days median (target achieved)

2022 to 2023: 6 working days median (target achieved)

Key performance indicator: time taken to conclude misuse of title cases

Target: monitor

2023 to 2024: 55 working days median

2022 to 2023: 34 working days median

Key performance indicator: time taken to answer emails

Target: less than or equal to 5 working days

2023 to 2024: 2 working days (target achieved)

2022 to 2023: 2 working days (target achieved)

Key performance indicator: time taken to answer phone calls

Target: less than or equal to 8 minutes

2023 to 2024: 6 minutes (target achieved)

2022 to 2023: 8 minutes (target achieved)

Fitness to practise key performance indicators

Key performance indicator: age of triage caseload

Target: less than or equal to 14 weeks by March 2024

2023 to 2024: 23 weeks (target missed)

2022 to 2023: 16 weeks (target missed)

Key performance indicator: age of investigation caseload

Target: less than or equal to 54 weeks by March 2024

2023 to 2024: 62 weeks (target missed)

2022 to 2023: 60 weeks (target missed)

Key performance indicator: time taken to complete the case examination process

Target: less than or equal to 12 weeks

2023 to 2024: 10 weeks (target achieved)

2022 to 2023: 8 weeks(target achieved)

Key performance indicator: time from receipt of referral to final fitness to practise outcome

Target: monitor

2023 to 2024: 110 weeks median

2022 to 2023: 109 weeks median

Key performance indicator: time taken to approve interim orders

Target: less than or equal to 20 working days

2023 to 2024: 18 working days (target achieved)

2022 to 2023: 18 working days (target achieved)

Key performance indicator: fitness to practise internal quality score

Target: more than or equal to 90%

2023 to 2024: 91% (target achieved)

2022 to 2023: 94% (target achieved)

Information governance key performance indicators

Key performance indicator: time taken to complete Freedom of Information requests

Target: more than or equal to 90% within deadline

2023 to 2024: 100% (target achieved)

2022 to 2023: 98% (target achieved)

Key performance indicator: time taken to complete subject access requests

Target: more than or equal to 90% within deadline

2023 to 2024: 100% (target achieved)

2022 to 2023: 99% (target achieved)

Corporate complaints key performance indicator

Key performance indicator: corporate complaints response time

Target: more than or equal to 70% within 20 working days

2023 to 2024: 90% (target achieved)

2022 to 2023: 78% (target achieved)

Finance key performance indicator

Key performance indicator: forecast year-end variance to budget

Target: +/- 1.5%

2023 to 2024: 0.1% (target achieved)

2022 to 2023: 0.7% (target achieved)

IT key performance indicator

Key performance indicator: system availability excluding planned outages

Target: more than or equal to 99%

2023 to 2024: 99.9% (target achieved)

2022 to 2023: 99.8% (target achieved)

People key performance indicator

Key performance indicator: sickness absence over last 12 months

Target: less than or equal to 5.4 days per person

2023 to 2024: 8.9 days (target not met)

2022 to 2023: 6.0 days (target not met)

Summary of risks

As we work to achieve our strategic and business objectives, managing our corporate risks effectively is paramount to our success. Our corporate risk register brings together our key risks regarding our ability to:

• achieve timeliness within our regulatory processes and stand behind the decisions we make

• respond to the external and policy landscape

• effectively manage our resource position

• defend ourselves from cyber incidents.

In 2023 to 2024, some of our corporate risks had a greater impact on our ability to achieve our objectives than others. This year, the number of cases awaiting a hearing became too great for us to manage within a reasonable timescale using our existing resources. We first anticipated this circumstance in July 2021 and added the emerging risk to our risk register.

In October 2023, our executive leadership team decided to manage this as an issue, as the risk had materialised. We’re working determinedly to address the delays in hearing cases. We're identifying any further opportunities to improve the timeliness, efficiency and effectiveness of our process within our available resources and our legal framework.

Additionally, 2023 to 2024 saw cost of living pressures continue to stretch everyone. We were not immune to them. We had to adjust our spending plans due to higher building charges and to make a cost of living payment to our staff. We were successful in finishing the year with a +/-1.5% budget variance, however costs subsequently increased following a review and restatement of accruals balances relating to legal fees. Further information can be found in note 1.19.

During 2024 to 2025, we’ll continue to focus on how we can drive further efficiency improvements across our organisation. We’ll work with our sponsor, the Department for Education, to review our overall resourcing needs now and into the future, building the case for additional funding where necessary.

Performance analysis

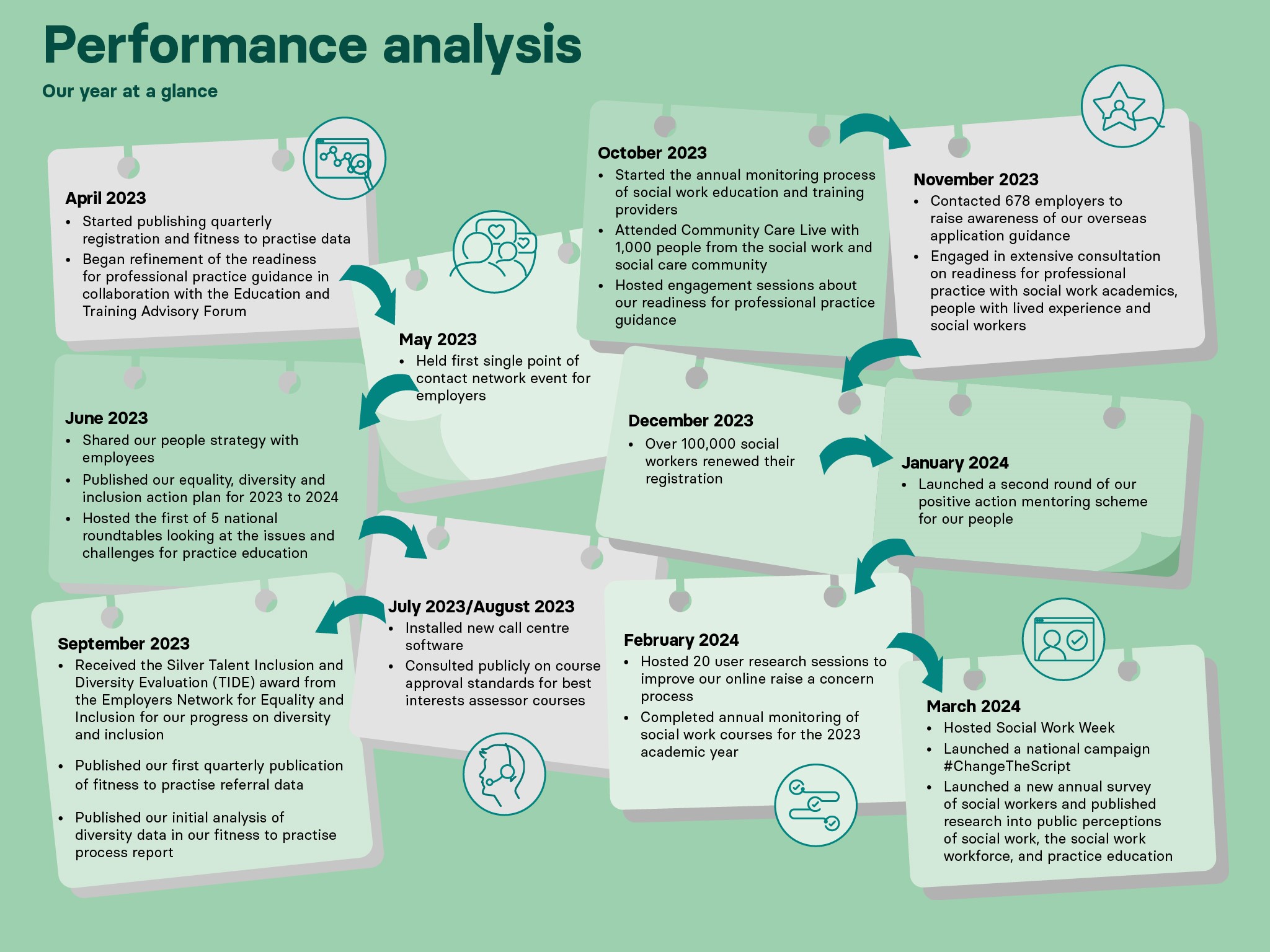

Our year at a glance

April 2023

- Started publishing quarterly registration and fitness to practise data

- Began refinement of the readiness for professional practice guidance in collaboration with the Education and Training Advisory Forum

May 2023

- Held first single point of contact network event for employers

June 2023

- Shared our people strategy with employees

- Published our equality, diversity and inclusion action plan for 2023 to 2024

- Hosted the first of 5 national roundtables looking at the issues and challenges for practice education

July/August 2023

- Installed new call centre software

- Consulted publicly on course approval standards for best interests assessor courses

September 2023

- Received the Silver Talent Inclusion and Diversity Evaluation (TIDE) award from the Employers Network for Equality and Inclusion for our progress on diversity and inclusion

- Published our first quarterly publication of fitness to practise referral data

- Published our initial analysis of diversity data in our fitness to practise process report

October 2023

- Started the annual monitoring process of social work education and training providers

- Attended Community Care Live with 1,000 people from the social work and social care community

- Hosted engagement sessions about our readiness for professional practice guidance

November 2023

- Contacted 678 employers to raise awareness of our overseas application guidance

- Engaged in extensive consultation on readiness for professional practice with social work academics, people with lived experience and social workers

December 2023

January 2024

- Launched a second round of our positive action mentoring scheme for our people

February 2024

- Hosted 20 user research sessions to improve our online raise a concern process

- Completed annual monitoring of social work courses for the 2023 academic year

March 2024

- Hosted Social Work Week

- Launched a national campaign #ChangeTheScript

- Launched a new annual survey of social workers and published research into public perceptions of social work, the social work workforce, and practice education

Performance against objectives (analysis)

We’ve been working to the ambitions set out in our 2023 to 2026 strategy. We have reviewed performance against our business plan priorities for 2023 to 2024.

Strategic theme: prevention and impact

A vital part of why we exist is to maintain professional standards in social work. People should have trust in their social worker and confidence that they have the skills and expertise to meet their needs. Our work aims to incrementally grow:

- confidence in the way we regulate

- the proportion of social workers who understand how the professional standards apply to their work

- confidence in social work as a profession and how it is positively viewed by society

Objective 1.1: develop an inclusive communications and engagement approach to improve understanding of social work and professional standards

Engaging with the profession and people with lived experience

Our engagement team engaged with a total of 10,891 external individual stakeholders this year.

During the year we have increased our engagement with employers on overseas recruitment. We emailed 678 employer contacts to raise awareness of guidance. We also offered support to all employers and agencies recruiting candidates who qualified outside of the UK.

The number of requests from higher education institutions for in-person support from our engagement team increased this year. As a result, we’ve been able to deliver two-way feedback relating to our fitness to practise and registration processes.

We also delivered 14 national CPD and registration renewal sessions and 14 peer reflection sessions. We received fewer requests for bespoke CPD and registration renewal sessions than in 2022 to 2023. This decline suggests there is a better understanding of registration renewal and CPD requirements.

To shape our regulation, we continue to engage with people with lived experience, including children and young people. We listen to their experience of social work and their understanding of professional regulation.

Co-production

Co-production is one of our guiding principles. We work on the principle that people should feel heard and that we have listened to their experiences.

Our National Advisory Forum is central to this approach. It acts as our critical friend and brings real-life advice, support and challenge to drive positive change in social work.

During the year, we welcomed 10 new members to the forum. Through targeted recruitment we brought in social work students and those with expertise from the private, voluntary and independent sectors of the profession.

Annual social worker survey

In March 2024, we launched a new annual survey for social workers to gather their thoughts on:

- the effectiveness of our regulation

- the professional standards

- how society values social work

The results will support us to understand and track perceptions of social work, and confidence in us and the profession. The findings will inform our communication and engagement approach.

Social Work Week

Now in its fourth year, over 6,500 people attended the main sessions at Social Work Week. We co-produced 21 sessions with people working across the sector and those with lived and learned experience.

These sessions are available on our YouTube channel, providing further opportunities for those interested in social work to build their understanding of the profession.

We are committed to evaluating the impact of this event on the profession and other attendees to inform our future approach.

Informing and educating: #ChangeTheScript campaign

In early 2024, we launched a public campaign calling on the entertainment and media industry to more accurately reflect social work in TV and film. We drew on our research and used ringfenced funding granted by the Department for Education.

The campaign aimed to inform and educate the public on the reality and the role of social work. It also sought to raise awareness among scriptwriters and filmmakers of the consequences that negative depictions of social workers have on society.

We co-produced the campaign with a working group who brought a diverse range of experiences from both social work and non-social work backgrounds.

#ChangeTheScript included a short film, featuring impactful real stories of social workers from the perspective of the people they support.

Launched on 18 March, early evaluation of the campaign through to the end of March shows:

- coverage in over 35 national, regional and broadcast outlets and in leading social work sector publications which helped to inform and educate the public on social work

- 1,800 views of the film on YouTube and our website, and almost 100,000 opportunities to see content across social media channels

- endorsement and amplification by key sector stakeholders including government departments, employers and social workers through their own communication channels

- an early shift in perception of the profession among those engaging with the campaign, with the number of people who strongly agreed that the profession deserves more recognition than it currently receives increased by 67% after viewing the film

Looking ahead

In our 3 year strategy we have committed to placing greater emphasis on targeted communication and engagement to enable positive change in social work. We aim to continue our work to inform, educate and influence others on the varied role social work plays within society. We'll use learning from the campaign and Social Work Week to work towards this goal.

Longer term, we hope these activities will increase confidence both within and outside of the profession for the benefit of the people social workers serve.

Data and insight

We have an important and informed viewpoint on the profession, drawn from our data and insight, our research, our engagement and our experience.

We use data and insight to inform our activities and how we regulate. Sharing data and insight about the social work profession and our regulation helps us to support leaders and policy makers to drive change. It also means that our processes are safe and fair.

Objective 2.1: implement our data and insight strategy

In 2023, we began to publish a range of data and insight we hold about the social work profession and our regulation.

Online data and insight hub

In September, we started to publish regular data and insight on a new online data and insight hub. This includes:

- monthly data on our social work register and fitness to practise cases

- quarterly overseas application data

- fitness to practise process: an initial analysis of diversity data

- quarterly fitness to practise referral data

There have been over 2,500 views of our data and insight hub pages since they launched at the end of September. These pages have also formed the basis of a number of engagement activities.

Exploring our diversity data

Our report titled Fitness to practise process: an initial analysis of diversity data was published in September 2023. We found that the following groups of social workers were overrepresented in referrals received by us, and cases referred to hearing:

- social workers aged 40 and over

- male social workers

- social workers from a Black, African, Caribbean or Black British

Our analysis also showed that these groups have higher progression rates from triage to investigation, as well as from case examination to hearings.

This report represented a significant first step for us towards a comprehensive understanding of fairness in our processes. It also helped us to identify the actions we must take in response. We are conducting further analysis to better understand causality for these overrepresentations. We have established a data oversight group to ensure our analysis is robust.

Benchmarks and insight

We are committed to continuously learning more about social work and why it has a vital role in society. As such, we gather data and intelligence about the social work profession and people’s experiences to inform our activities.

Public perceptions of the social work profession

In 2023 we commissioned YouGov to investigate how people in England feel about the social work profession. We wanted to know whether they understand and have confidence in what social workers do. We also wanted to find out how they feel about the regulation of social work by Social Work England.

It was reassuring to see that members of the public, healthcare professionals, and social workers themselves, think social workers play an essential role in society. Those in training and in practice said that they came into social work because they wanted to make a difference in people’s lives and be fulfilled by a meaningful career. Despite this, only 1 in 10 social workers think they are well respected in society, whereas 44% of members of the public reported that social workers were respected. As part of our commitment to support the social work profession, we’ll be doing more to understand why these different perceptions of social work exist.

We complemented our perceptions research by commissioning YouGov to help us better understand the social work workforce. This insight will inform where future interventions might be helpful to address workforce challenges.

Practice education in England: a national scoping review

We commissioned research in 2023 to better understand:

- practice education

- the models of practice across education providers and employers

- the perceptions of social workers undertaking this role

Our research found that there are effective local networks in place that support the delivery of practice education. The findings have deepened our understanding of the perceptions of practice educators, course providers and placement providers.

Building on our existing insights and experience, this research is helping to shape our approach to the regulation of practice education. As always, we will work with the sector to ensure that any potential future regulation is proportionate, risk based and in the public interest.

Looking ahead

In 2024 to 2025, we'll build on this activity by sharing more of our research findings, thematic reviews and analysis of data. Doing so will increase our openness and transparency and support wider learning.

We’ll continue to use significant moments to start national conversations on the role of the social work profession within society. These opportunities may include new reports, publications, news, data and events. We’ll monitor any trends, themes and emerging regulatory risks, aligned with our purpose to protect the public.

National policy

We want every social worker to be able to practise, develop and progress in an environment that supports safety and effectiveness. We explore and challenge what professional regulation and the framework of our legislation can achieve towards this goal. But there are limits to what our regulation alone can do for public protection and professional confidence.

Effective public protection and regulation increasingly means prevention. It means identifying and reducing threats and risks to public protection at a more systemic level, as well as focusing on individual social workers.

Objective 3.1: influence and advise on the development of national policy and statutory guidance

There has been significant sector review and reform, both in adults and children’s social care, through the Department for Education’s Stable Homes, Built on Love strategy and the Department of Health and Social Care’s People at the Heart of Care strategy. We engaged with the 2 departments as well as stakeholders throughout these processes, providing organisational responses to consultations. Our work included 5 Department for Education consultations relating to reform. It also involved the Department for Health and Social Care’s call for evidence on the Care workforce pathway for adult social care. We advised on policy developments, such as the early career framework and we explored the potential implications for our future regulation, drawing on our data, insight and research.

This area is evolving and could potentially result in changes to our regulation. We’re monitoring the work closely and continue to consider the implications for our own strategic priorities in professional practice.

Workforce pressures are a significant risk for the profession. High numbers of vacancies continue to exacerbate high pressure working environments, making recruitment and retention a challenge. Intense workloads and burnout are leading social workers to leave front line roles. Despite these challenges, our data shows that social workers are not necessarily leaving social work altogether. Over a 3 year period our register has grown from 99,702 social workers in November 2020, to 103,324 in November 2023.

Building on our research findings, alongside sector leaders we’ve continued to take forward planning to address these workforce challenges. We worked with the sector to explore critical issues such as retention, recruitment and the impact and implications of recruiting social workers who qualified overseas.

Looking ahead

We’ll continue to use our experience and expertise to help inform national policy agendas. We’ll also continue to work with the sector on the pressing workforce challenges, to understand what could better support the profession.

Education and training

A key strand of prevention and impact is ensuring those who graduate from social work qualifying courses are ready to register and practise as social workers. We regulate social work education and training through approving and inspecting qualifying courses on a 5-year cycle. We are on track to conclude our first round of inspections by the end of 2024, which will mean:

- we will have inspected all social work courses

- all course providers will have evidenced that they meet our education and training standards

- students who successfully complete a course can meet our professional standards

On completion of our first inspection cycle, we will have a clear picture of the different routes into social work, and how courses are being delivered.

Objective 4.1: develop and implement the readiness for professional practice guidance

During 2023 to 2024, we established the Social Work Education and Training Advisory Forum. The forum provides opportunities for stakeholders to discuss and help shape strategic priorities and to act as our critical friend. Through this engagement, we are refining and strengthening our approach to the knowledge, skills and behaviour statements included in our readiness for professional practice guidance.

We’ve also held ongoing conversations and engagement events with education providers, practice educators, students, people with lived experience of social work and the wider sector. These discussions have supported the development of the guidance. We’ll finalise the guidance in 2024 and work with the forum to share it with the sector.

Best interests assessors (BIAs) and approved mental health professionals (AMHPs)

In 2023, we consulted on new education and training approval standards for BIA courses, following our consultation on AMHP courses in 2022. We have drafted guidance to support these standards.

We'll publish both sets of standards and guidance in 2024 and implement them the following year. This will begin a cycle of reapproval for all AMHP and BIA courses, as part of our plans to develop to a closer relationship with people working in these specialist and advanced roles.

Objective 4.2: review approach to course inspections, reapprovals and quality assurance

We continue to make progress on our inspection cycle. In 2023 to 2024, we have:

- met our target for reapproval decisions, inspecting 106 courses

- continuously engaged with higher education institutions and training providers to explain our role, our expectations, and our approach

- completed annual monitoring with all 78 education and training providers in England

- responded to over 350 enquiries from higher education institutions, local authorities, students and members of the public

- surveyed course providers to gauge their experience of our inspection process to help inform future directions

We have also continued to streamline our systems and processes. We have done all of the following:

- completed end-to-end mapping of the education quality assurance process, developing an internal continuous improvement plan

- started to plan for BIA and AMHP course inspections

- started to explore digital improvements to ensure our education quality assurance process is as efficient and effective as possible

Looking ahead

During 2024 to 2025, we’ll inspect and make reapproval decisions for the remaining courses. We'll use this intelligence to provide a fuller analysis of the education and training landscape for social work. We’ll also analyse emerging trends from our inspection experience. This learning will inform our review of our education and training standards. We'll look at how we can ensure our approach to inspections, reapprovals and quality assurance is effective and sustainable.

We’ll also consider the role of annotations to the register, to provide the public with information about the capabilities of social workers with specialist roles. We will begin with AMHPs, BIAs and practice educators.

Strategic theme: regulation and protection

Registration and advice

We require social workers to renew their registration and demonstrate that they meet our professional standards on an annual basis. This way they show that they are capable of safe and effective practice, ensuring public protection and increasing public confidence. As part of this process, we set annual continuing professional development (CPD) requirements that social workers must meet to maintain their registration. As such, we encourage a culture of learning and development that is ongoing, sustained and embedded in practice.

This year, we improved our search the register functionality. It is now easier for the public to search for a social worker and identify whether they hold registration and whether they have any conditions on their registration.

Objective 5.1: identify opportunities to improve the timeliness, fairness and quality of our registration and advice processes

Timeliness

In 2023 to 2024 we procured and installed new software for our contact centre to handle enquiries. This upgrade has supported our responsiveness and ensured accurate reporting of calls and email activity.

We met our targets for time taken to answer phone calls and emails. During the year, we received 35,291 calls, slightly fewer than the 36,672 calls received last year. However, we received 41,004 emails compared to 25,691 last year. The new contact centre software has allowed for better data recording of emails we receive. We believe this change is key to the increase in email volumes we have recorded.

We also met our target timescales for assessing applications to join and restore to the register.

Fairness and quality

Over 100,000 registered social workers in England engaged with us during the registration renewal period. Identifying opportunities to improve the fairness and quality of our registration and advice processes is central to our operations. During 2023 to 2024, we further improved fairness in our registration functions by:

• reviewing processes for our assessment of UK, overseas and restoration applications

• using learning to keep processes efficient, proportionate and rigorous on public protection

We have created new guidance on misuse of the title social worker and overhauled our public guidance for:

• UK and overseas applicants

• applicants who wish to return to the register

• safe and effective practice

Using our learning and feedback from the sector, our updated guidance clearly explains our expectations of applicants and social workers. Doing so has increased the fairness in understanding and navigating our processes for users. For misuse of title cases, it will ensure that investigations are proportionate to the period of misusing the title.

Registration renewal: 1 September to 30 November 2023

Following a review of last year’s registration renewal cycle, we didn’t make any significant changes to the registration renewal processes, systems or CPD requirements this year.

We supported 101,052 (98%) social workers to renew during the registration renewal period through a wide range of targeted and multi-channel communication activities, including:

• emails tailored to communicate specific outstanding actions

• text messages to improve cost efficiency and responsiveness

• improvements to and promotion of guidance for applicants

The compliance rate and lower volume of enquiries this year indicate that social workers are increasingly familiar with the registration renewal requirements.

We became more transparent in publicly reporting registration renewal data, publishing regular and consistent updates on our website. We published information about the registration renewal outcomes on our website on 6 February 2024.

As with previous years, we randomly selected 2.5% of social workers for a CPD review. A team of 9 independent CPD assessors completed this review between January and March 2024. They accepted 2,406 (97.7%) social workers’ CPD. They gave 57 (2.3%) advice on how to improve their recording of CPD. The assessors noted that the quality of CPD recording had improved this year. Social workers showed better understanding when describing the impact of their learning on their practice.

CPD is a key element of our growing relationship with social workers. We’ll continue to strengthen this relationship by promoting further adoption of learning, development and reflection as a routine and valued part of professional life. We’ll explore whether we need to make any changes to our guidance, engagement and digital delivery to support this ambition.

Objective 5.2: identify ways we can improve the timeliness of overseas applications

In 2023 to 2024 we received 1,742 applications to join the register from people who qualified overseas. This number represents a 3% decrease on the volume received in 2022 to 2023. This includes multiple applications from people whose previous application was not completed, therefore the number of successful unique applicants is lower.

Overseas registration application: cases opened

Annual totals (financial years) of applications received from those who qualified outside of the UK.

- 2020 to 2021: 687

- 2023 to 2022: 1,212

- 2022 to 2023: 1,803

- 2023 to 2024: 1,742

There is correlation between the significant increase in application volumes since 2020 to 2021 and processing times associated with overseas applications. Processing times increased from a median of 29 working days in 2022 to 2023 to a median of 57 working days in 2023 to 2024.

In response to these challenges we have:

- updated our guidance for overseas applicants, in collaboration with social work representative bodies and international recruitment agencies

- held discussions with International English Language Testing System (IELTS) to understand the availability of their tests and gain some assurance that applicants will not be affected by delays once they sign up for a test

- produced examples of updating skills and knowledge forms to help applicants provide the right information

- implemented a checklist for applicants, making additional contact to check they have provided all required information to support their application

- met with international regulators, recruitment agencies and UK local authorities to understand their processes and plans so that we can better support each other

Activities are ongoing to help us understand and manage the high volume of overseas applications within the resources that are available.

Objective 5.3: review our approach to concerns about misuse of the protected title of social worker

Social worker is a protected title. It is illegal for a person to use the title unless they have completed the required education and training and are registered with us. Dealing with title misuse is an important part of our duty of public protection.

The volume of misuse of title cases continued to increase in 2023 to 2024. This increase related to concerns raised by the public querying why someone was not on our public register. It also included cases where people practised while not holding registration, often after failing to renew their registration.

Along with resource challenges in the registration service, this increase in volume led to longer closure times. This year it took an average of 55 days to conclude a case, compared to 34 days last year.

To address this concern, we published guidance on misuse of title cases. We also introduced changes to the assessment of restoration applications. People are now able to return to practise appropriately and efficiently.

These improvements have started to reduce the time it takes us to resolve cases.

Looking ahead

In 2023 to 2024, we reviewed our registration and advice processes to identify opportunities to improve timeliness, fairness and equality. This work included specific focus and new guidance on overseas applications and misuse of title cases. During 2024 to 2025, we’ll implement the changes we’ve identified and further develop our approach.

Fitness to practise

It is our responsibility to investigate concerns raised to us about social workers. We take this action to protect the public, maintain public confidence in social workers, and uphold professional standards.

It’s vital that we investigate such concerns in a fair and transparent way. Specialist teams operate each activity in our fitness to practise process:

- Our triage service considers the concerns we They make an initial decision on whether or not we should investigate further.

- The investigations team then gathers evidence on referred concerns to help determine whether there may be fitness to practise issues.

- Case examiners make decisions following the conclusions of investigations. They close cases using the outcomes available to them or refer cases to a hearing.

- Our hearings service ensures that public hearings deal fairly with referred cases.

- Our case review team works with social workers who have restrictions on their They ensure that these social workers can demonstrate how they’re working to meet the requirements of their restrictions. We might apply these restrictions as interim orders during the course of our investigation, or decision makers may apply them once they have reached a final decision.

- Our quality assurance activities help us make appropriate and reasonable decisions and highlight where we need to develop or improve. Where appropriate, we involve those with lived experience of social work, often through our National Advisory At times we engage other stakeholders too. Our work is also subject to scrutiny by the Professional Standards Authority and the courts.

In line with our objectives, this year we focused on reviewing and analysing our approach to fitness to practise, to identify areas for improvement.

We also focused on the impact of changes made to our legislative framework in December 2022.

Fitness to practise data

During the year, we started to publish monthly data relating to our social work register and fitness to practise cases. Our yearly summary below shows the volume of activity and the proportion of cases that progressed to each stage of the fitness to practise process.

On 31 March 2024, there were 2,128 open fitness to practise cases.

The numbers below are based on decisions that we made on cases at each stage of fitness to practise during the year, including those that we opened in previous years.

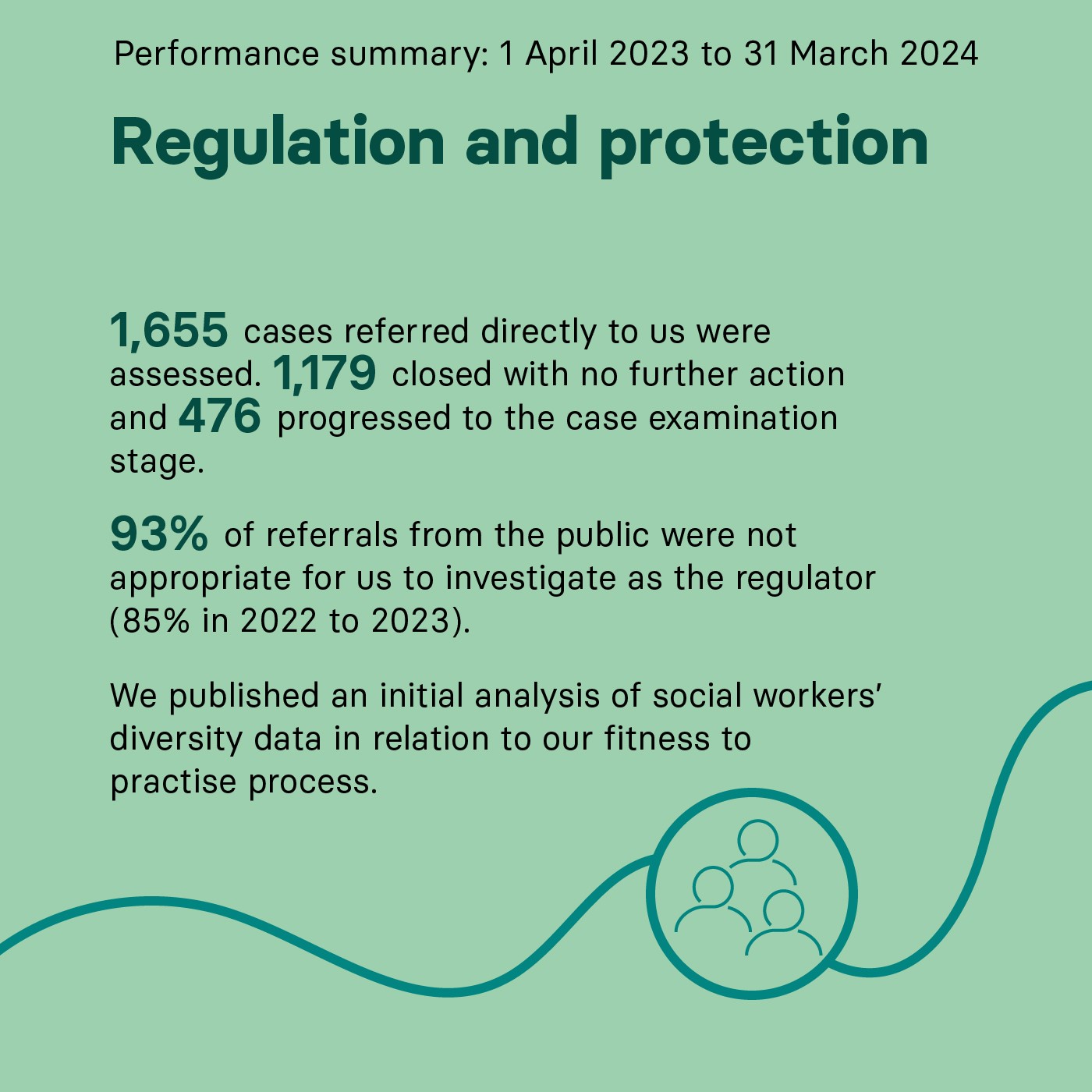

We made 1,655 assessment decisions across the pre-triage and triage stages of our fitness to practise process. Of these decisions:

- 71% (1,179) were to close cases with no further action

- 29% (476) were to progress cases to the case examination stage Case examiners made 422 decisions, of which:

- 50% (210) were to take no further action

- 29% (122) were to refer to a hearing

- 21% (90) were to close cases by means of accepted disposal

Where we found there was a realistic prospect of impairment at the case examination stage, we applied the following accepted disposal outcomes:

- 53% (48) warning orders

- 20% (18) conditions of practice orders

- 11% (10) removal orders

- 11% (10) suspension orders

- 3% (3) no further action

- 1% (1) advice

We decided 125 cases at hearings, finding:

- 67% (84) of cases where the social worker’s fitness to practise was impaired

- 33% (41) of cases where no impairment was found

Where we found that the social worker’s fitness to practise was impaired at the hearings stage, we applied the following sanctions:

- 44% (37) suspension orders

- 32% (27) removal orders

- 13% (11) warning orders

- 8% (7) conditions of practice orders

- 2% (2) no further action

Fitness to practise case outcomes

During the year, 1,613 cases reached a final outcome, of which:

- 73% (1,179) were closed with no further action, without referral to case examiners

- 13% (210) were closed by case examiners with no impairment found

- 6% (90) were closed by accepted disposal

- 5% (84) were closed at a hearing where impairment was found

- 3% (41) were closed at a hearing with no impairment found

- 1% (9) cases were closed for other For example, voluntary removal from the register or removal from the register on another fitness to practise case.

Reflecting on fitness to practise referrals

Our fitness to practise function has expanded its understanding of the number and nature of the concerns we receive. We’ve continued to refine how we manage these concerns at all stages of the process.

This year we received 1,617 referrals (1,769 in 2022 to 2023), of which 1,172 have a known source. Of these:

- 337 (339 in 2022 to 2023) were from employers of social workers

- 641 (861 in 2022 to 2023) were from members of the public

- 194 (261 in 2022 to 2023) were from other sources

Members of the public made 55% of referrals, down from 59% in 2022 to 2023. These referrals were primarily from people who use the services of social workers.

At the triage stage, we referred 79% of the concerns we received from employers into our investigation process (88% in 2022 to 2023). 93% of referrals from the public were not appropriate for us to investigate as the regulator (85% in 2022 to 2023). For example, we cannot:

- influence court proceedings

- investigate concerns about social care services or employers of social workers

On our website we are clear about the types of concern we can consider.

Objective 6.1: identify opportunities to bring more investigative activity into the earlier stage of the fitness to practise process

Timeliness continued to be the focus in our triage and investigation stages. Case progression is dependent on a number of variables. As such, we expected the median age of caseloads for these stages to fluctuate over the year.

At the investigation stage, gathering evidence from employers, social workers and other parties is more challenging than we originally anticipated. Many of our cases require us to seek primary evidence to understand:

- the context of the social worker’s involvement

- whether and how the issues raised by the third party relate to the social worker’s professional judgements

Often this process can take time because:

- records are not available or forthcoming

- staff involved have left their roles

- service users are unwilling to engage with us

We’re working hard to build relationships with employers through our single point of contact network but this work takes time to embed.

This year, we implemented new approaches to support our teams to progress their older and more complex cases. And we strengthened our approach to identifying and managing risk. We delivered learning and development activity to help teams be more targeted at the early stages and to better the quality of our investigations. We also improved our induction pathway for new investigators to support them more in their first few months.

Objective 6.2: optimise our approach to accepted disposals by reviewing the case examination stage

We met our target for the time we take to complete the case examination process. Throughout the year we used learning from the accepted disposal process to inform the rest of the fitness to practise process. Our quality audits of the process and decisions have been positive. Together with representative bodies we also co-produced guidance for social workers who are considering accepted disposal.

We continued to review cases where offers of accepted disposals were not accepted, to share learning with the case examiners. We will keep on holding thematic reviews with the case examiners to support further improvements. We will closely monitor timeliness as we optimise the accepted disposal decisions process.

Objective 6.3: ensure our hearings process is efficient and delivers value for money

With the support of additional funding from the Department for Education, we dedicated significant focus to conclude almost all the legacy caseload inherited from the Health and Care Professions Council (HCPC). We completed our project to conclude the legacy caseload at the end of June 2023.

We worked to identify the position of all cases awaiting hearing, to be able to make decisions on their progression within our available financial resources. Our level of resources did not allow us to reduce the number of cases awaiting hearing. During the year, we informed many social workers that they would have to wait longer than they expected for a final fitness to practise outcome. We notified social workers of the status of their case and kept complainants and witnesses updated. We continue to prioritise cases awaiting hearing based on the risks we have identified and the age of the case.

This year we reviewed our hearings processes, and these have been subject to a positive internal audit. We launched a pilot of 2-person panels for some final hearings, which will continue across 2024 to 2025. This approach could bring about financial savings that we can then reinvest into progressing more final hearings. Through the pilot we'll understand which cases are best suited to 2-person panels without affecting the quality of decision making.

We also analysed the reasons for adjournments and postponements as well as refining our approach to data collection. Our adjournment and postponement rate in 2023 to 2024 was 20%, compared to 24% in 2022 to 2023.

Objective 6.4: demonstrate impact following the changes to our revised legislative framework, focusing on interim order timeliness, quality of voluntary removal decisions, and efficiency and outcomes of case examiner decision review process

Changes to our regulations, rules and guidance came into effect in December 2022. The changes we made included the following:

- a change in the frequency of interim order reviews, from every 3 months to every 6 months

- the ability for us (at our discretion) to remove social workers who are subject to a fitness to practise process from the register, if the social worker asks for this to happen

- the ability for case examiners to remove social workers from the register with the social worker’s agreement

- giving us the power to refer cases directly for consideration of an interim order, rather than going through case examiners or adjudicators

- the ability for us to review and seek a new case examiner This approach applies when we have reason to believe that new information has become available or that the decision may be materially flawed.

We reviewed whether these changes achieved the benefits we expected in efficiency and effectiveness. We’re satisfied that we could see positive outcomes across them all, without any reduction in the quality of the decisions we make.

Interim order process and timeliness

This year we made 52 applications for an interim order under the new process described above. Making applications directly allows us to identify and manage potential risks more effectively. We continued to meet our timeliness target for approving interim orders.

Voluntary removal

We have considered 44 applications for voluntary removal from social workers who are in the various stages of the fitness to practise process and 15 applications for voluntary removal have been granted.

We held internal and external stakeholder workshops to review and streamline our voluntary removal processes. With voluntary removal being new to our legal framework, we've reviewed all decisions we made about it during 2023 to 2024. These reviews have assured us that our voluntary removal decisions are of good quality.

Case examiner decisions

Our legal team reviewed 13 case examiner decisions using their new powers. Of these:

- 7 were closed by the legal team

- 2 were referred back to the case examiners for a fresh decision

- 4 are being considered

Impact on quality

We continued to meet our target for our fitness to practise internal quality score.

Our decision review group regularly reviews a sample of fitness to practise decisions and have looked at thematic reviews. It has shared its learning with the case examination decision makers and panel members to refresh and improve our processes.

Looking ahead

In 2024 to 2025, we’ll implement our learning and continue to monitor our performance. We’ll focus on encouraging better engagement with social workers at an early stage.

We’ll also explore further opportunities to improve quality, fairness and value for money. This includes our ongoing work on analysis of diversity in fitness to practise, and implementation of our quality framework for case examiners.

Objective 7.1: develop our single point of contact network and explore local resolution pathways

Over the past few years, we’ve developed a network of single points of contact with employers of social workers.

We also started work with employers and others to understand how local complaint and concern processes are working. Due to capacity constraints, we’ve planned further exploration work for 2024 to 2025. We’ll continue to make sure that we provide a route to engage with local employers about current fitness to practise cases. At the same time, we’ll help others deal with complaints as close as possible to where the issue arose.

Looking ahead

In 2024 to 2025, we’ll nurture and develop the network, building on the learning from our evaluation. We’ll increase collaboration to better understand the national, regional and system issues affecting the profession.

Strategic theme: delivery and improvement

In 2023 to 2024 we focused on continuing to improve the approaches and systems that underpin our work.

Key to these developments are:

- our digital services

- attracting and retaining skilled, committed and valued people

- effective leadership, governance and oversight Our strategy explores this theme in more detail

Digital user experience

Our digital platforms are our main point of contact with the public and the profession. For many, our digital services will be the only point of interaction they have with us. Their experience will significantly impact on the trust and confidence they have in us as a public body. Our digital approach must therefore be inclusive, informative and intuitive for our users, while always keeping data secure.

Objective 8.1: carry out user research to identify how to improve digital user experience

User research

Our first step in shaping our future digital strategy was developing and implementing a new way of involving users of our services in our work. We’re now able to identify and bring together a group of diverse participants, to feedback on and shape our digital content. Doing so will help us to provide more user-friendly, inclusive digital services.

In February 2024, we delivered user research on how we can improve our raise a concern service. To stay true to our co-production values, we engaged with 20 people with lived experience on this.

Over 20 sessions we tested 2 different versions of our raise a concern online process. We developed scenarios with our professional advisers and matched them to participants to reflect their lived experience where possible. Our testing focused on:

- accessibility

- clarity of information

- how participants felt when using the services

We'll use our learning to optimise the raise a concern service. We’ll also feedback to participants about how their inputs helped shape the service.

Digital improvements

We improved the annual registration renewal journey for social workers. And we made further improvements to our case management system to help our people work efficiently. We also created a new equality, diversity and inclusion section on our website

Accessibility

We’ve completed an accessibility audit to ensure our website remains inclusive. We've updated and published our accessibility statement on our website, to be transparent with users on where improvements are required. Work to educate our people on the importance of inclusive communication is on track. We'll continue this internal work to ensure our people understand that accessibility is everyone’s business.

Looking ahead

In 2024 to 2025, supported by our user research, we’ll deliver further accessibility improvements. We’ll continue to improve our case management systems and improve our data architecture. We’ll also consider how artificial intelligence might offer opportunities to improve efficiency and effectiveness. We'll give careful consideration to any potential implications for privacy and fairness.

Be a diverse and inclusive employer

It’s only through the hard work, commitment, skills and knowledge of our people that we can deliver our strategy. Everyone in the organisation has an important role to play in carrying out our plans and contributing to:

- protecting the public

- enabling positive change in social work

- improving people’s lives

Objective 9.1: implement our people strategy

In June, we began implementing our people strategy for 2023 to 2026. Our priority areas are:

- attraction, retention and workforce planning

- cultivating our strong and inclusive culture

- health and wellbeing

- leadership and talent development

We've made improvements to our recruitment process throughout 2023 to 2024, including:

- enhancing the careers page on our website

- changing our interview approach so candidates can showcase their skills and experience

- developing and increasing the data we hold

- researching and benchmarking internally and externally to identify and share best practice

We plan to review the impact of these improvements during 2024 to 2025 and explore further how we can attract a wider range of talent.

Looking ahead

We’ve made steady progress over the first year of our people strategy. We'll continue to build on these achievements in 2024 to 2025. In particular, we’ll focus on our culture and ways of working. We’ll also develop a behaviours framework to support and underpin these efforts.

Continually develop and improve how we work

We continue to develop our governance and quality assurance frameworks. We’re focused on how they can drive continual improvement in the quality and timeliness of our decision-making and promote public confidence. We seek to contribute positively to societal and environmental challenges. By developing and improving how we work, we ensure we're a well-run organisation that delivers the right outcomes and provides value for money.

Objective 10.1: further develop and communicate quality and assurance frameworks

Assurance frameworks helps us to understand:

- how well our systems of internal control are working

- whether we’re effective in assessing and managing risks

We developed and implemented our assurance framework this year, starting with our regulatory departments. Through this process we identified that we have adequate controls and assurances across all regulatory functions. We reported areas of strength and improvement to the audit and risk assurance committee. The learning has informed our priorities for quality assurance and continual improvement in 2024 to 2025.

We continue to be robust and considered in how we manage the information we hold, including personal data, and how we respond to requests for it. This year we responded to 228 data subject rights requests, and 226 freedom of information requests. As in previous